Using Bybit Margin Trading: Pros, Cons, and Tips

================================================

[**Backcom Bybit**](https://backcom.app/exchanges/crypto-cashback/bybit-cashback/) **has emerged as a significant player in the cryptocurrency exchange landscape, offering a range of trading products to cater to diverse investor needs. Among these, margin trading stands out as a powerful, albeit risky, tool for amplifying potential returns.**

Margin trading essentially allows users to borrow funds to increase their position size, magnifying both potential profits and losses. Understanding the nuances of Bybit's margin trading system is crucial for anyone looking to navigate this high-stakes environment successfully.

The Mechanism of Bybit Margin Trading

-------------------------------------

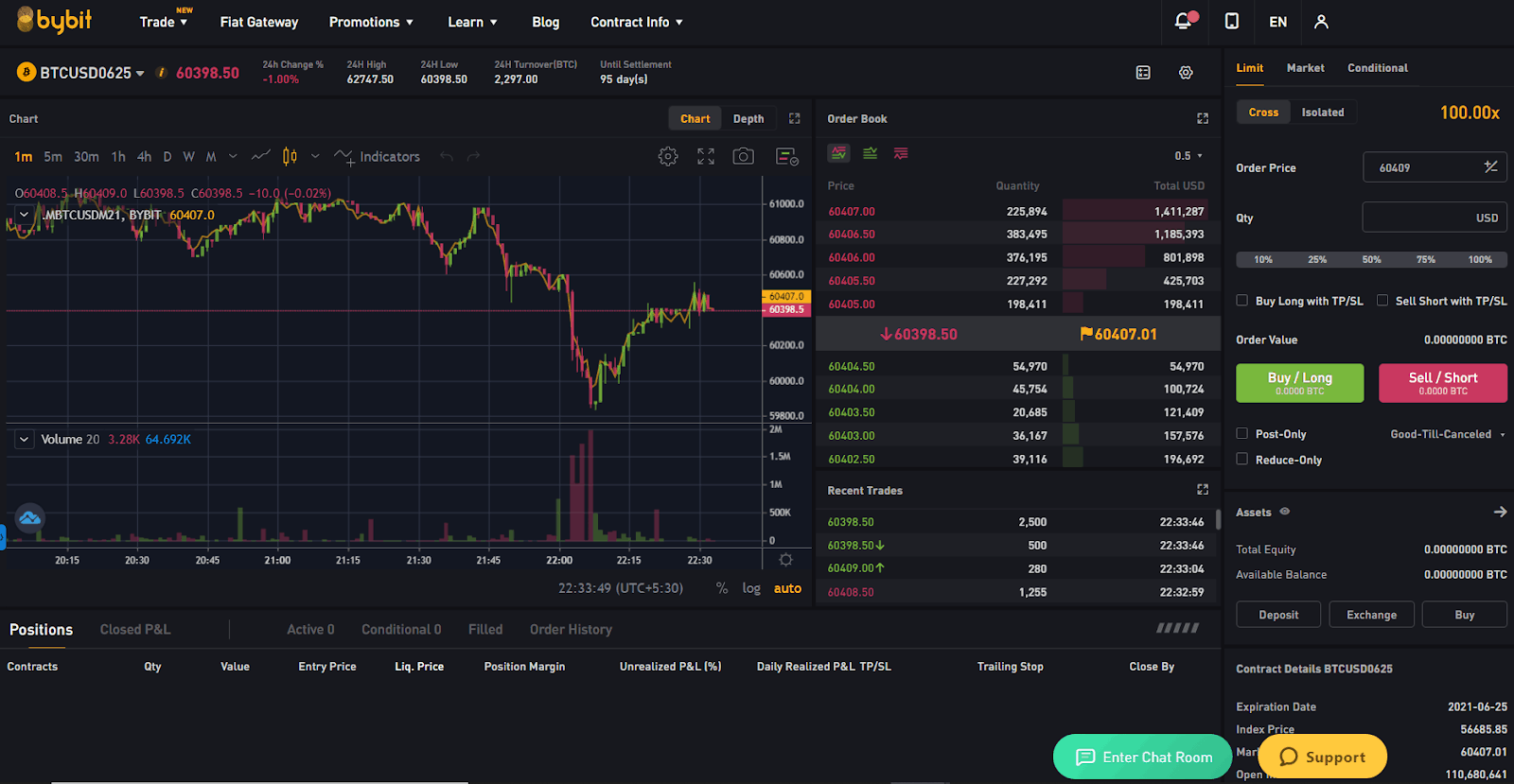

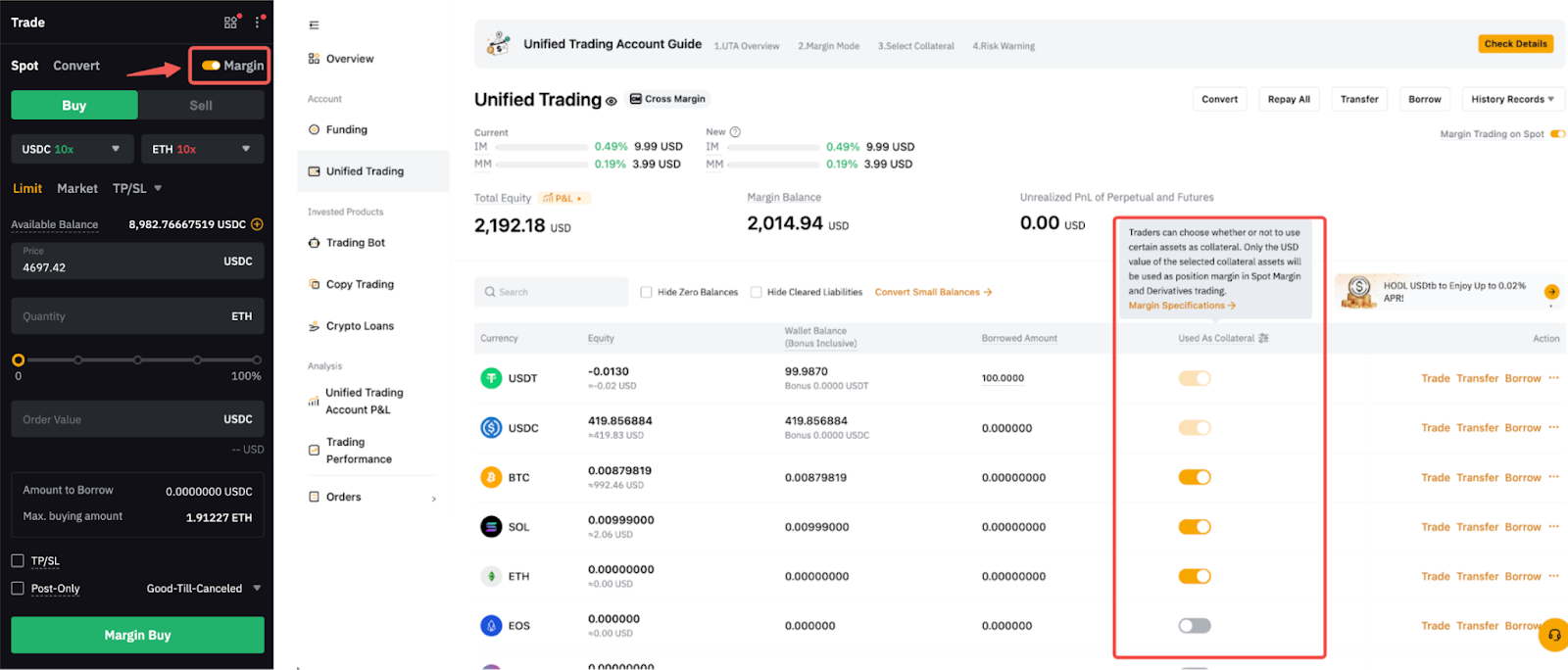

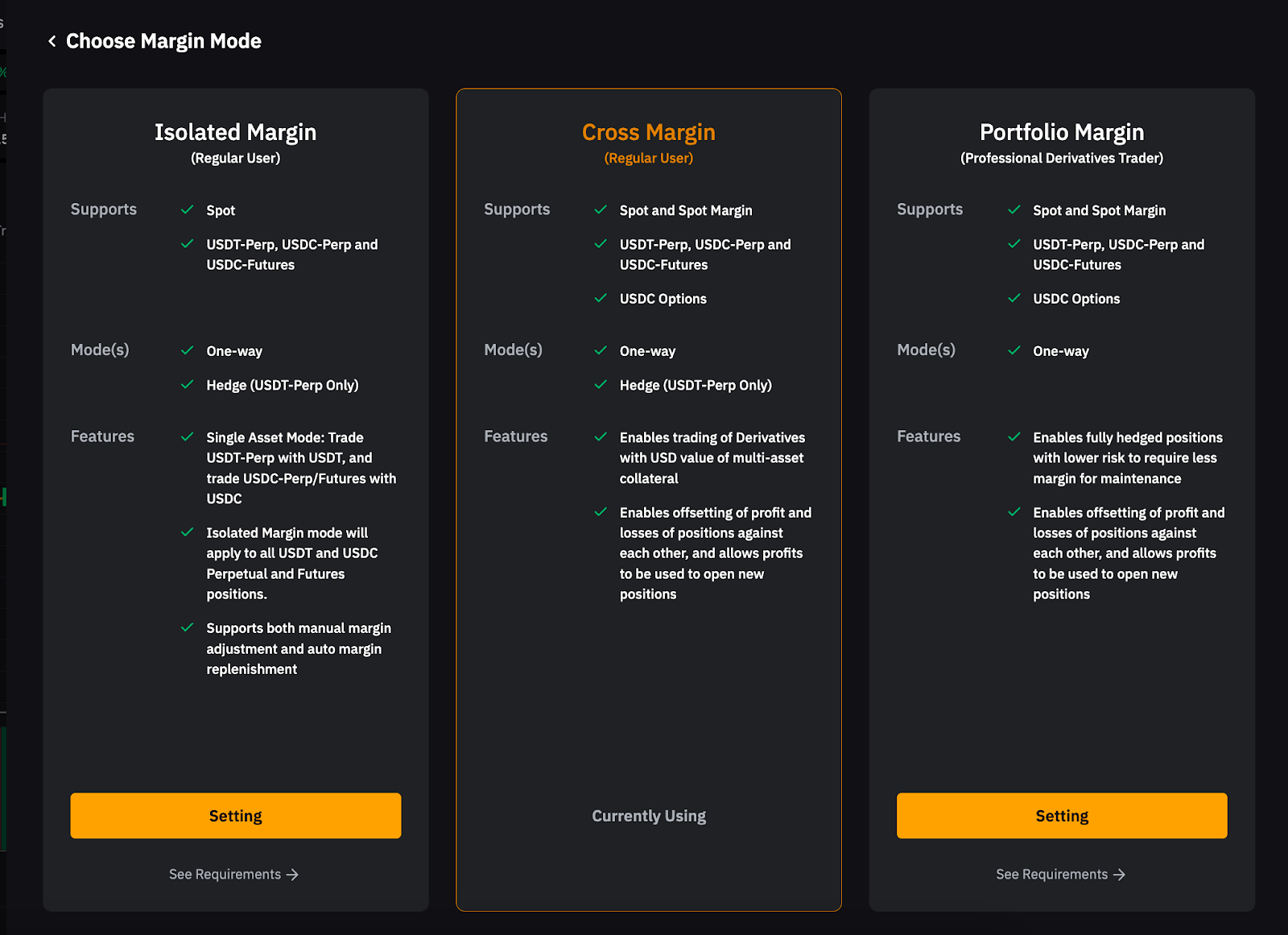

On Bybit, margin trading is typically available on the Spot and Derivatives markets. In simple terms, you put up a fraction of the total trade value (your collateral or "margin"), and the exchange lends you the rest. For instance, with 5x leverage, a $1,000 position only requires you to put up $200 of your own capital.

The key concepts to grasp are:

* **Initial Margin:** The minimum amount required to open a leveraged position.

* **Maintenance Margin:** The minimum amount of equity required to keep the position open. If your equity falls below this level, you risk liquidation.

* **Leverage:** The ratio of the position size to the initial margin (e.g., 2x, 5x, 10x).

Pros of Using Bybit Margin Trading

----------------------------------

### Amplified Profit Potential

The most compelling advantage is the ability to generate significantly higher returns on successful trades. By using borrowed capital, a small movement in the asset's price can result in a much larger percentage return on your initial margin.

### Capital Efficiency

Margin trading allows you to control a larger position with a smaller amount of capital. This means you don't have to sell other assets or deposit more funds to participate in a trade you believe will be profitable.

### Short Selling Capability

Margin trading facilitates short selling, allowing you to profit from an asset's price decrease. By borrowing an asset, selling it, and planning to buy it back later at a lower price to repay the loan, you can capitalize on bear markets.

Cons and Risks Associated with Bybit Margin Trading

---------------------------------------------------

### Amplified Loss Potential

Just as profits are magnified, so are losses. If the market moves against your position, the losses can quickly deplete your initial margin, leading to a margin call or, worse, forced liquidation.

### Liquidation Risk

Liquidation is the single greatest risk. If your position's value drops to the point where your margin falls below the maintenance margin level, Bybit will automatically close your position to prevent further losses to the borrowed funds. This often results in the loss of your entire initial margin.

### Interest and Funding Fees

Since you are borrowing capital, you must pay interest (on Spot Margin) or funding fees (on Derivatives/Perpetual Contracts). These costs can erode potential profits, especially on positions held for extended periods.

Essential Tips for Bybit Margin Trading

---------------------------------------

To mitigate the inherent risks, successful margin traders employ disciplined strategies.

### Start Small and Understand the Tool

If you are new to leverage, begin with very low leverage (2x or 3x) and a small amount of capital. Familiarize yourself with how P&L (Profit and Loss), margin ratios, and liquidation prices change with market movements before scaling up.

### Master Risk Management with Stop-Loss Orders

This is arguably the most crucial tip. Always set a **Stop-Loss** order at a predetermined price level to automatically close your position before potential losses wipe out your capital. A well-placed stop-loss is your primary defense against catastrophic liquidation.

### Monitor the Liquidation Price Closely

Bybit provides a real-time calculation of your estimated liquidation price. You must monitor this value constantly. If the market approaches this price, consider adding more collateral to your position (increasing your margin) to lower the liquidation price and give your trade more breathing room.

Conclusion

----------

Bybit margin trading is a powerful financial instrument that, when used responsibly, can significantly enhance trading results. However, it is a double-edged sword that demands respect and a robust risk management strategy.

Author: [Backcom App](https://backcom.app/)